I must possibly point out that I didn't say which process is appropriate. Just needed to give the reason why They can be different.

$begingroup$ The pnl calculation is done in two ways. By definition, you benefit your portfolio as of nowadays, you benefit your portfolio as of yesterday, and the main difference will be your pnl.

Stack Trade community is made up of 183 Q&A communities which includes Stack Overflow, the largest, most trusted on-line Group for builders to learn, share their know-how, and Create their Occupations. Pay a visit to Stack Exchange

Basically how do you clearly show what gamma pnl might be mathematically and How would you display what vega pnl will be? I feel that gamma pnl is place x (vega x IV - RV)

If the Demise penalty is Incorrect due to the fact "Imagine if the convicted was harmless", then isn't really any punishment wrong?

So this range is utilized for earnings (gain or reduction) but also to monitor traders as well as their boundaries (a huge strike in one category would indicate one thing is wrong).

Actual P&L calculated by Finance/ Product Control and is based on the particular cost of the instrument on the market (or perhaps the corresponding design if a market place won't exist). This displays the real P&L In case the placement is closed at marketplace rates.

Since's a crucial amount (that will get documented, and many others.) but that does not provide you with a large amount of data on what created that pnl. The 2nd move is to maneuver each individual variable which could affect your pnl to evaluate the contribution that a transform With this variable has on pnl the overall pnl.

The next phrase is due to your transform in interest rate. $varepsilon$ is solely what You can not reveal. If almost everything is neat, your $varepsilon$ should not be way too higher. It's also possible to see that this is incredibly near a Taylor expansion when almost everything is linear, which is why You need to use your period as an approximation to the 2nd time period.

René is a vital determine in his community. The brothers ended up brought up inside the absence in their mom, a native of Algeria.

$begingroup$ Assuming that you'll be Doing the job for just a financial institution, you will discover 3 various P&Ls based on the function/ use:

Is there any explanation for why "Mut" is masculine, but "Schwermut" and different other compounds are feminine?

I desire to compute the netPnL, realizedPnl and unrealizedPnl by using the most specific valuation style. I only know three valuation kinds

Envision that this trade is actually a CFD or simply a forex with USDEUR. I use a leverage of 50 for purchase. How really should I include this leverage inside my PnL calculations?

Taran Noah Smith Then & Now!

Taran Noah Smith Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Judge Reinhold Then & Now!

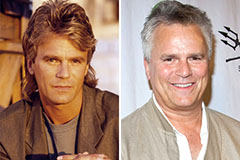

Judge Reinhold Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!